The world of financial markets is a realm that’s not only propelled by economic indicators and corporate performances but also marked by fascinating quirks known as market anomalies. These anomalies present a deviation from the standard market theory, which assumes efficiency and rational behavior. Yet, the reality is more complex and textured, revealing patterns and behaviors that defy simple explanation. For our local neighborhood enthusiasts, potential home buyers and sellers, and community business owners, understanding these anomalies isn’t just academic; it’s a window into the intricate dance of investment opportunities.

Market anomalies come in various flavors, broadly categorized into time-series and cross-sectional types. Time-series anomalies, like the curious ‘January effect,’ show us how stocks can unexpectedly surge at the start of the year, particularly those that didn’t perform well previously. Then there’s the ‘weekend effect,’ where stocks tend to behave differently on Mondays compared to Fridays. Cross-sectional anomalies reveal other interesting patterns, such as the ‘value effect,’ where stocks with low price-to-book ratios outperform their glossier counterparts. Each of these phenomena offers clues to the underlying currents that move financial markets, suggesting that they’re not as efficient as once thought.

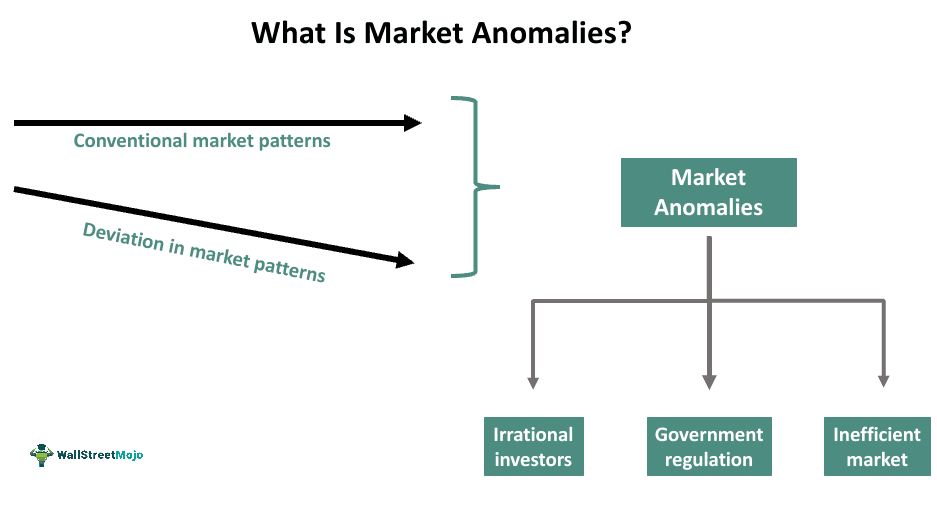

- An illustrative overview of market anomalies, providing a foundational understanding for investors. Source: investorsportfolioservices.com

Diving into real-world examples helps demystify these anomalies, making them more relatable for our community. Take the “Dogs of the Dow” strategy, an approach that involves investing in the ten highest dividend-yielding stocks of the Dow Jones at the start of the year and then adjusting annually. This strategy capitalizes on the reversal anomaly, which posits that last year’s underdogs might just lead the pack this year. These strategies and examples exemplify how systematic patterns in the market can be identified and potentially leveraged for gain, suggesting that far from being random, market movements often follow discernible, albeit unpredictable, paths.

The implications of understanding and adapting to market anomalies in one’s investment strategy can be profound. Savvy investors might use these insights to tweak their portfolios, perhaps by shifting allocations towards the end of the year to anticipate the January effect or by scouting for undervalued stocks that might be ripe for a rebound. This is not to suggest that exploiting market anomalies is a foolproof path to riches but rather to underline the value of a diversified investment strategy that takes these patterns into account. After all, acknowledging and understanding market anomalies can enhance our ability to navigate the unpredictable waves of the investment world.

Grasping the concept of market anomalies enriches an investor’s toolkit, offering a nuanced view that challenges the traditional paradigms of investing. It’s about recognizing the role of human emotion and behavior in financial markets and using that knowledge to make more informed decisions. For the residents, home buyers, sellers, and business entrepreneurs within our community, understanding these anomalies is akin to uncovering hidden gems in a vast ocean. As we navigate through the waves of an ever-changing financial world, being aware of these peculiar patterns could be the compass that guides us to more profitable shores.